ASIC New Money Rule

In 2017, the Australian Securities and Investments Commission (ASIC) issued a new consultation paper for Forex and CFDs Brokers. It is focused on the new client money rules that Australian Financial Services (AFS) licensees will need to apply starting in April 2018.

According to ASIC Commissioner Cathie Armour, “The client money rules will ensure greater transparency in relation to an AFS licensee’s receipt and use of derivative retail client money.” The new rule imposes record keeping, reconciliation, and reporting requirements on AFS license holders that provide forex and CFD trading. This new money rule ensures greater transparency in the market and prevents the use of client money for capital. This requires brokers use their own funds for hedging and expose themselves more to risk.

In a Finance Magnates article canvasing industry reaction to the new rule, Simon Stephen, Charterprime’s Managing Partner, offered, “The increased capital to operate coupled with rising operational costs may force less capitalised STP brokers to take greater risks to stay profitable. This would likely mean internalising more risk on the brokers’ book due to margin constraints at their hedging counter-party, or simply passing on these increased costs onto the client. A natural flow-on effect would be consolidation within the industry and a heightened barrier to entry.” ( Victor Golovtchenko, Finance Magnates 14/07/2017)

How This Affects Brokers

This new rule may not greatly impact larger firms and brokers. However, smaller brokers who choose to internalise more risk may have difficulty dealing with the increased risk. These brokers may need to invest in more sophisticated software that provides real-time risk and best execution monitoring, in order to survive.

Tapaas Can Help

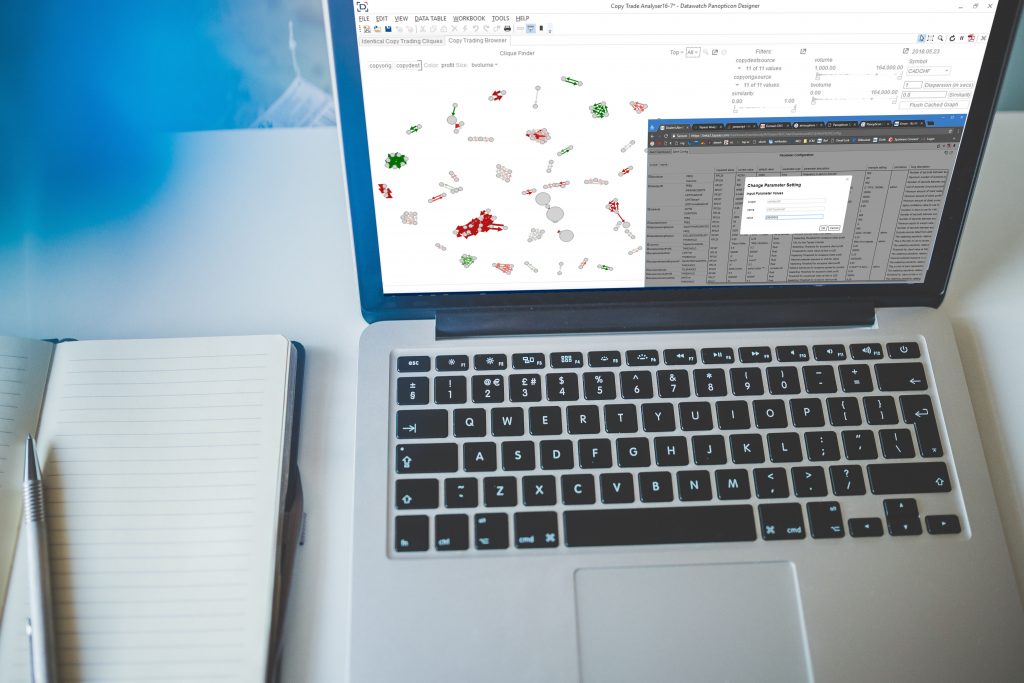

Tapaas provides a platform that addresses the FX brokers’ risk management and best execution challenges. The platform gives forex brokers continuous monitoring of real-time data and their associated risk across all servers. Through the capability of continuous monitoring, brokers are able to assess whether to warehouse certain trades or not. Tapaas enhances this feature by allowing easy migration of clients between A and B book. It facilitates the challenges of dealing with toxic traders and risk warehousing. Thus, The Tapaas Client Trading Toxicity Framework has been developed to detect, refine, and verify different toxicity strategies.

In addition to the aforementioned, Tapaas provides real-time recalculation of risk, exposure and PnL. In essence, real-time trade reconciliation helps ensure that an accurate picture of the trading positions is reflected. This way, risk can be better managed and broker’s strategies can be adapted accordingly. Further, custom alert messages are defined according to specific pre-set thresholds, as per the brokers’ individual needs. In general, Tapaas is here to enhance post-trade analysis and pre-trade selection through greater accuracy and availability of information. The Best Execution Explorer also assists brokers in getting the best prices for their bids and asks.

Tapaas provides profit through insight. In a market where prices can change in a matter of milliseconds, real-time and accurate information is key to success.

No comment yet, add your voice below!