broker risk

Manage various forms of risk to your brokerage effectively including market risk, counterparty risk and operational risk. Tapaas provides a comprehensive risk management solution that spans your entire estate to help protect your brokerage from a broad spectrum of threats. Whether you are large broker struggling to manage risk across a diverse array of trading platforms and bridges, or a small broker looking to grow your business through controlled leverage of risk, you need Tapaas.

warehouse risk

As a dealer, managing which trades you allow into your warehouse is the most important decision you need to make. Allowing toxic traders or bad actors into the warehouse can result in heavy losses. But with Tapaas, you can stay abreast of what’s happening in your warehouse, what traders in the warehouse are doing and even allows you to automatically eject toxic traders who breach specified performance or behavioural limits.

trader surveillance

Ensure that you are always protected from bad actors who seek to gain unfair advantage or cause disruption to your brokerage operation by employing comprehensive surveillance of all your clients’ activities. Tapaas allows you to concurrently scan in real-time for a multitude of different trader behaviours specifically tailored to your own parameters. This means that you’re always across your prevailing trader risk and it also allows you to meet your regulatory obligations around providing a fair and orderly market for your clients.

scalpers

Brokers need sophisticated defences against scalpers to prevent them suffering sizable aggregate losses from scalpers who chip away with a large number of small profitable trades over the day. Scalping detection is further complicated by some traders exploiting latency arbitrage to secure riskless profits. Tapaas provides multiple mechanisms that can identify, monitor and even automatically curtail such threats.

trader classification

Managing your clients is simplified by having clients automatically labelled according to their trading behaviour and performance. Tapaas will look for clients exhibiting behaviours like scalping, news trading, martingale, etc. and annotate clients accordingly. Additionally, clients displaying outlying trading characteristics relating to P&L, trade timing or trade volume will also be marked accordingly. This provides the dealer with essential context for them to optimally manage their overall real-time risk.

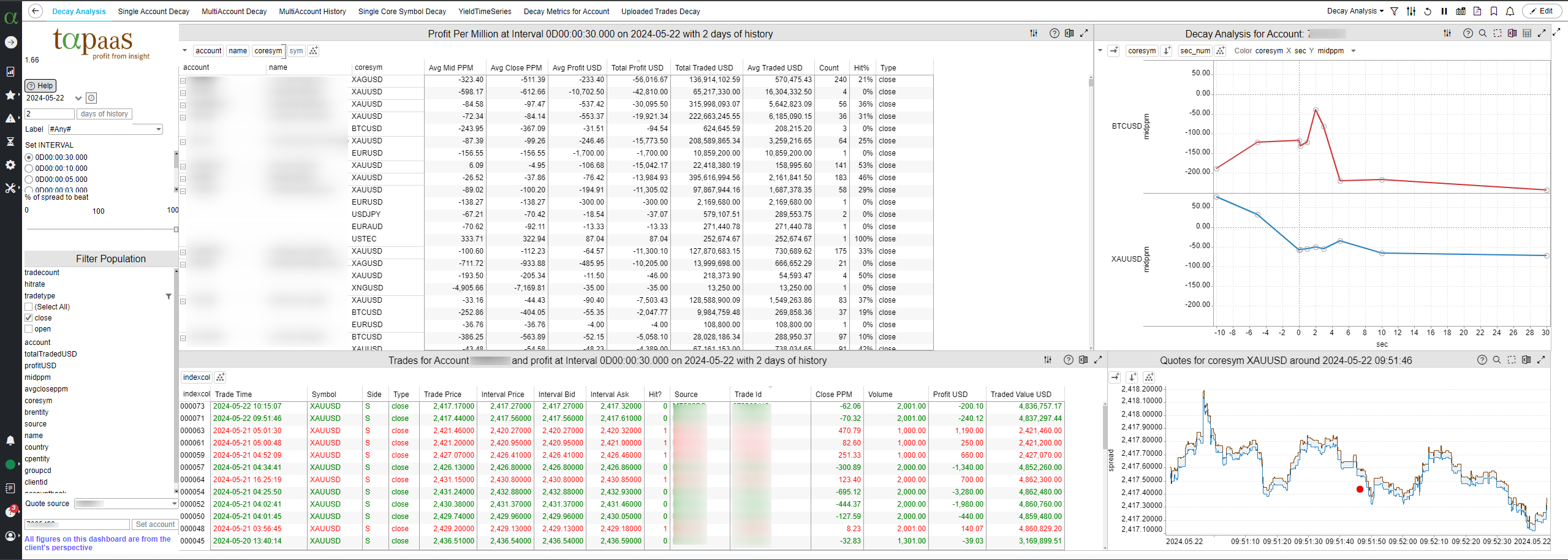

decay analysis

Do some clients appear to be too successful? Maybe they have an unfair advantage such as a faster pricing feed from an alternate broker. With decay analysis, you can see which clients are consistently executing trades that front run price movements and take timely action to prevent serious future losses.

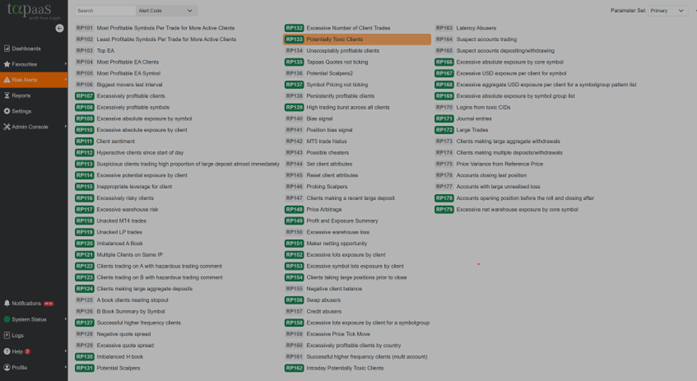

realtime alerts

Realtime alerts notifying significant risk factors are essential to effective risk management. Dealers can setup a broad spectrum of alert types that are tailored to a broker’s specific risk management policy. When these parameters are breached, Tapaas presents such alerts in an alerts dashboard. This not only shows the current state of any breach but also presents a timeseries view of the breach so the dealer can better evaluate the trajectory of the breach and assess its impact.

Tapaas supports lifecycle management of any alerted breach which allows multiple dealers to collaborate in making sure the breach is dealt with effectively and that there is an audit trail for regulatory and compliance purposes. Any alert can also optionally be communicated through email to a configurable audience.

Additionally, Tapaas can gateway alerts into third party issue management platforms like ZenDesk or they can be accessed through the Tapaas API.

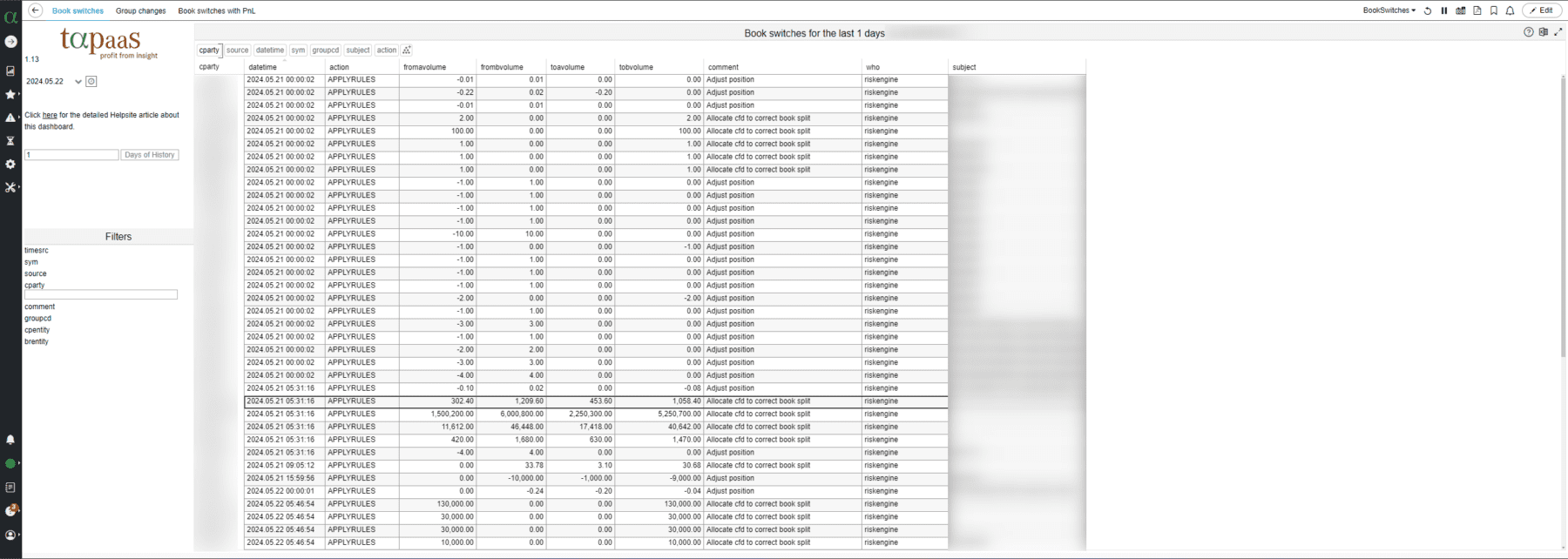

automated book switching

Do you struggle to keep your A book balanced when you change routing rules in your bridge or move clients between different groups? Tapaas can automatically track such changes, determine which client positions are impacted and even automatically re-hedge your A book through intelligent trading strategies. Dealers can even configure clients to be ejected from your warehouse automatically upon the breach of specified risk limits, with Tapaas performing the necessary hedges to keep your STP positions properly hedged.

risk metrics

Get deeper insight into your exposures through complex real-time risk metrics. Tapaas provides a comprehensive set of value at risk (VaR) metrics that allow you to measure possible and likely losses of your prevailing exposures based upon historical volatility across configurable periods.

exposure

Tapaas dashboards allow dealers to stay on top of their real-time exposures, drilling down to attribute constituent risk to specific clients, symbols, client groups, etc. Exposures can be viewed by symbols or currencies and also segmented by legal entities.

fraud

Brokers need to be continually vigilant scanning for bad actors that are looking to commit fraud. There are many attack vectors for such fraudsters and brokers need comprehensive threat detection mechanisms to thwart them. Tapaas can detect a variety of common fraud scenarios that can flag clients before they attempt to withdraw their winnings.

Tapaas can even combat dealer fraud where a dealer is conspiring with one or more clients to gain unfair advantage.

price arbitrage

Some traders may look to discover and exploit pricing anomalies in certain instruments to make a riskless or near-riskless profits. These anomalies might come from idiosyncrasies in the liquidity provider pricing or due to pricing latency differentials at your brokerage as compared to another broker. Tapaas can help detect clients engaging in arbitrage and allow a dealer to take remedial action in a timely fashion.

position keeping

At the heart of any risk management platform is real-time position keeping. Tapaas provides dashboards that allow the dealer to view and aggregate positions across all the broker’s trading platforms and legal entities. Dealers can utilise the full power of the business intelligence dashboarding to slice, dice and drilldown on a configurable number of breakdowns. This allows dealers to easily troubleshoot various risk scenarios and perform risk attribution. Tapaas provides full reconciliation between trading systems and the bridge, and the between the bridge and liquidity providers. This allows brokers to immediately detect any out-trades and take actions to remediate hedges.

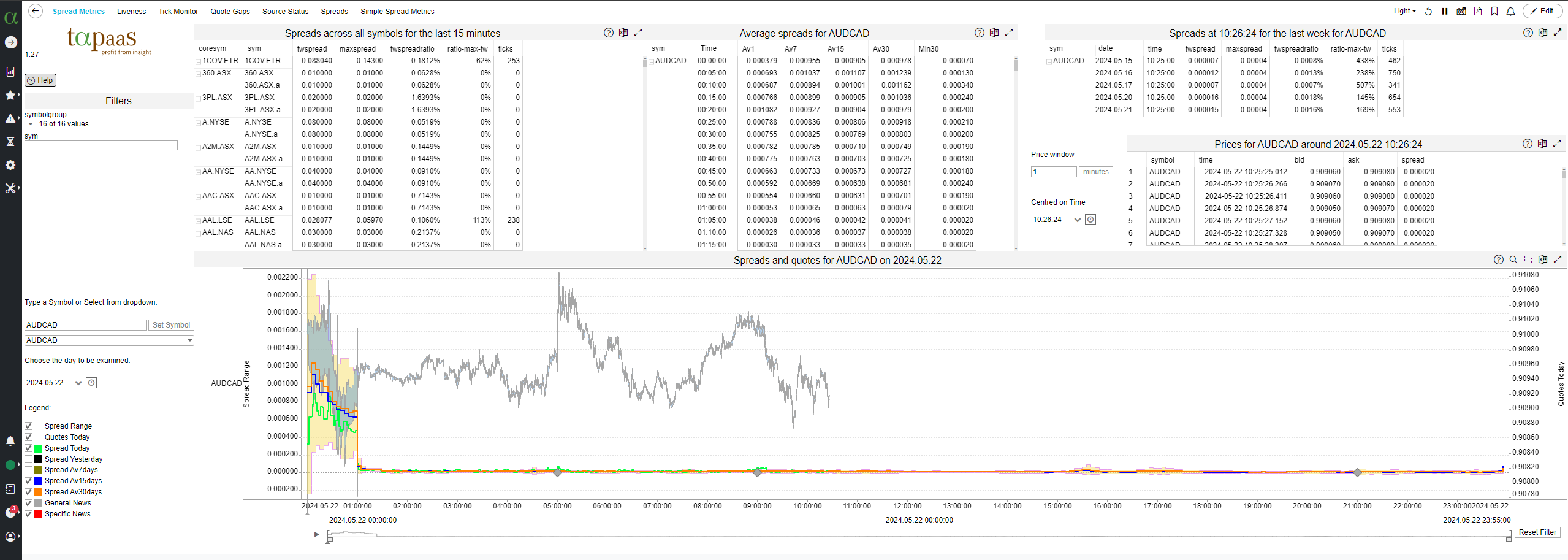

spread analytics

A broker’s competitiveness will to a large extent be determined by the quality of the liquidity that they can offer a trading client. It is important for dealers to closely monitor their pricing across the trading day and look for uncompetitive spreads or pricing anomalies. Tapaas can provide insights into both top of book pricing as well as individual liquidity provider pricing.

latency arbitrage

Bad actors will look to identify brokers who have sluggish pricing feeds compared to another faster broker and take advantage using latency arbitrage when trading against the warehouse. Tapaas continually scans for traders who appear to be probing a broker’s susceptibility to latency arbitrage as well as detecting instances when the arbitrageur begins to attack in earnest.

copy trading

Copy trading can be profitable for brokers but requires careful monitoring due to its propensity to amplify risk.

Tapaas can perform fuzzy matching analysis across the full range of client trading activity to determine which clients are engaged in some form of copy trading based upon dealer-specified coherence constraints.

trader collusion

Sometimes potentially large cohorts of traders (or trader bots) may act in concert to try to overwhelm broker liquidity and gain unfair advantage. Such collisional trading can be particularly dangerous to broker warehouses and can result in significant losses. Tapaas has powerful tools to finding such colluding trader cliques and for being able to visualise such trader linkages.

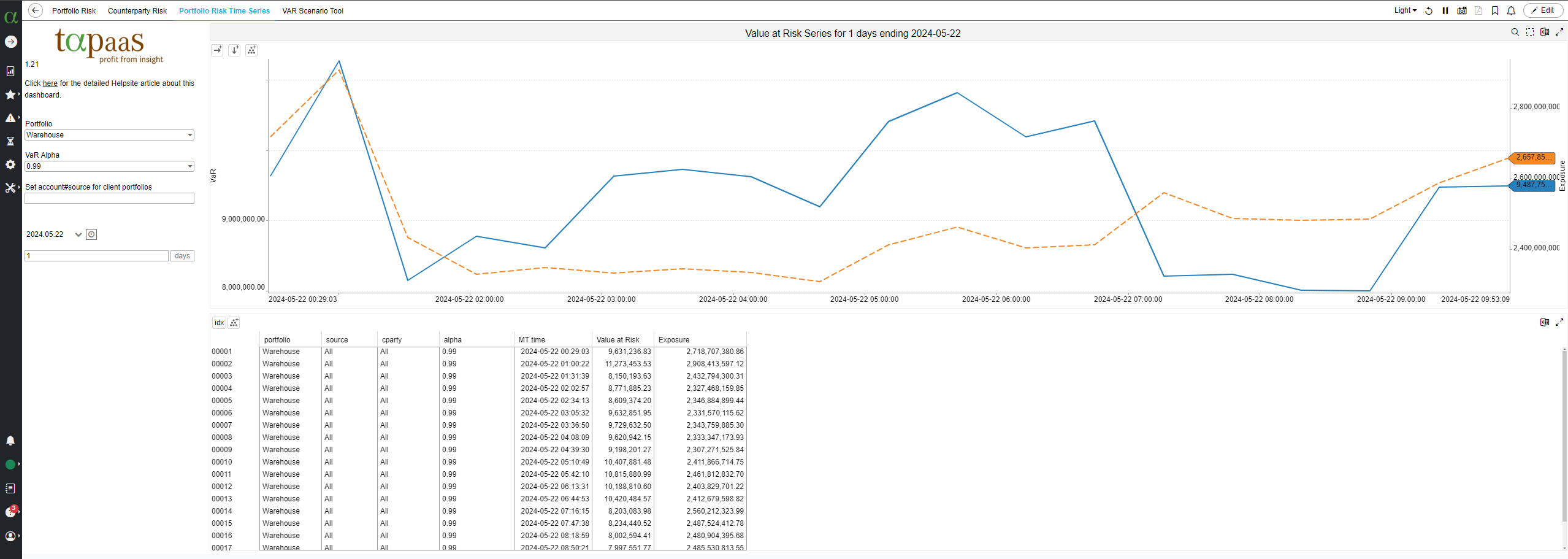

value at risk

Tapaas provides rich insights into a family of value at risk (VaR) metrics that can help dealers determine when warehouse exposures are becoming too risky given the prevailing market conditions. Supported algorithms span a variety of parametric and historical methods and can compute both minimal and likely losses.

Dealers can even experiment with various what/if scenarios to help them determine the impact of a set of hypothetical hedges.

trader performance

Tapaas provides comprehensive trader report card for all clients that allows dealers to quickly assess client performance. Dealers can also enable real-time alerts that will notify when traders exceed the envelope of parameters defined.

toxic trader

Dealers need to rapidly identify toxic traders that can cause significant damage to the broker. Tapaas has a variety of mechanisms that can identify such traders before they have inflicted significant damage. These include provision of decay analysis as well as a broad range of alerts that highlight highly profitable traders.

high frequency trading

With the vast majority of trading undertaken through EAs, the volume of trades has escalated significantly in recent years, way beyond the capacity of dealers to monitor manually. Tapaas providers dealers with the help they need help to scrutinise such trading, detect undesirable behaviours and rapidly take action to neutralise any threats.

credit abuser

Tapaas can assist locating traders who abuse free credit by placing complementary opposing orders in different accounts and relying on negative balance protection to protect them against a loss.

swap abuser

Swap abusers can use several techniques to earn guaranteed swap without taking significant risk. A popular technique leverages swap-free Islamic accounts while others look for short hold times across end of day. Tapaas can assist with the identification of such traders.

rebate abuser

Introducing broker rebates are often a big drain on a broker’s bottom line. Brokers need to guard against an IB’s traders churning trades for the sole purpose of earning rebates. Tapaas can help detect such scenarios and enable the broker to take remedial action.

martingale

Tapaas detects traders employing trading strategies with martingale characteristics.

range trader

Tapaas can identify range trading strategies that focus on symbols that are overbought or oversold based upon existing support and resistance levels, where clients place trades that anticipate a reversion of the price towards its longer term mean.

news trader

Tapaas maintains an economic calendar which allows the identification of traders who trade predominantly around significant planned news announcements. This helps provide valuable context for dealers in dealing with various risk scenarios.

day trader

Tapaas can detect clients using day trading strategies.

sentiment

Tapaas computes trader sentiment metrics per instrument for various time periods that can help dealers identify real-time shifts in trading flows.

pricing anomalies

Tapaas can monitor for various pricing anomalies such as negative quote spreads, excessive quote spreads or excessive price moves between ticks. Upon detection, the dealer is immediately notified to facilitate rapid remediation.

quote monitoring

One of the key operational risks for a broker is making sure that all instruments that should be available for trading are indeed pricing and that prices look reasonable. Tapaas provides powerful tools to highlight pricing issues immediately and enable the dealer to rectify any underlying problem before clients are severely impacted or try to take advantage.